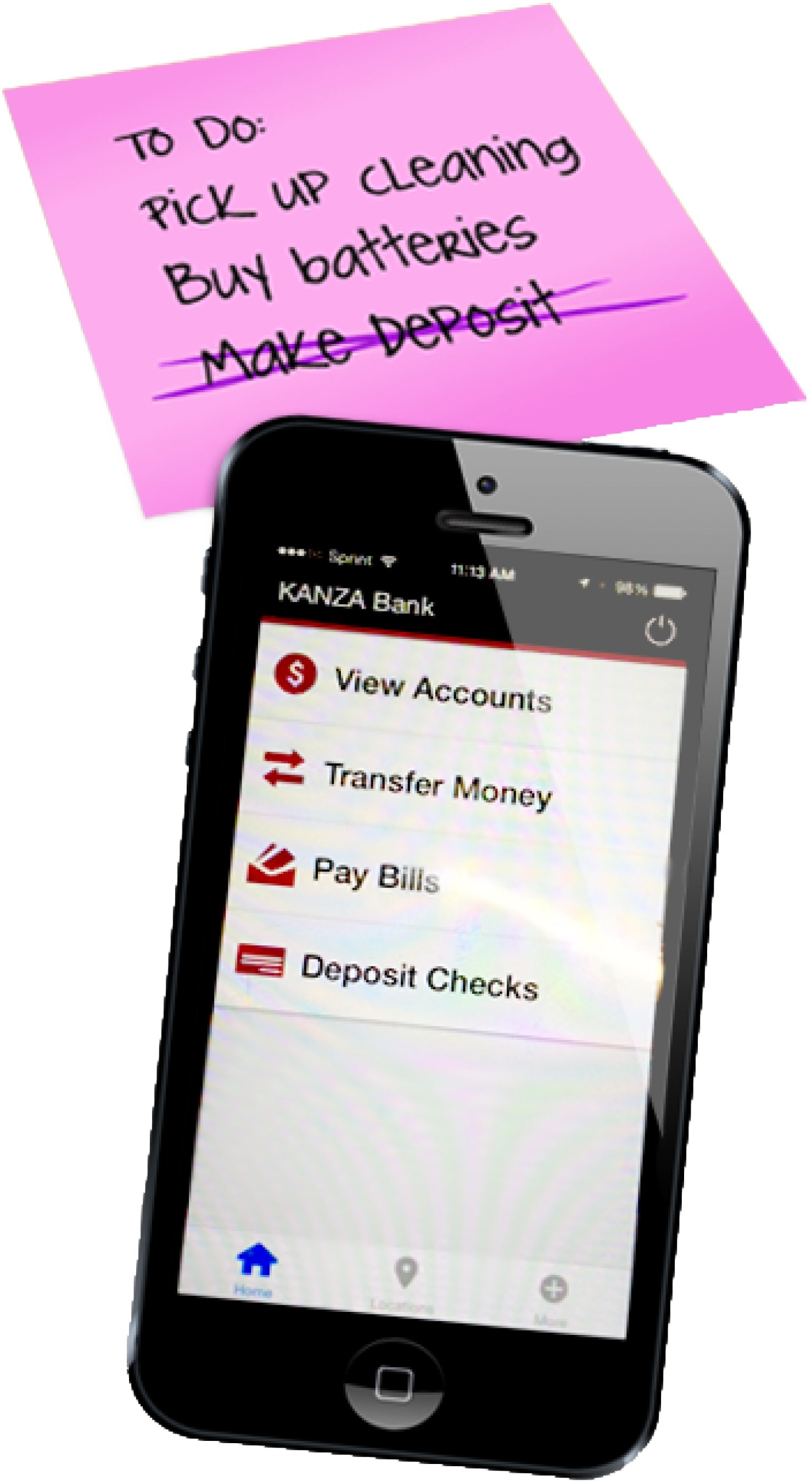

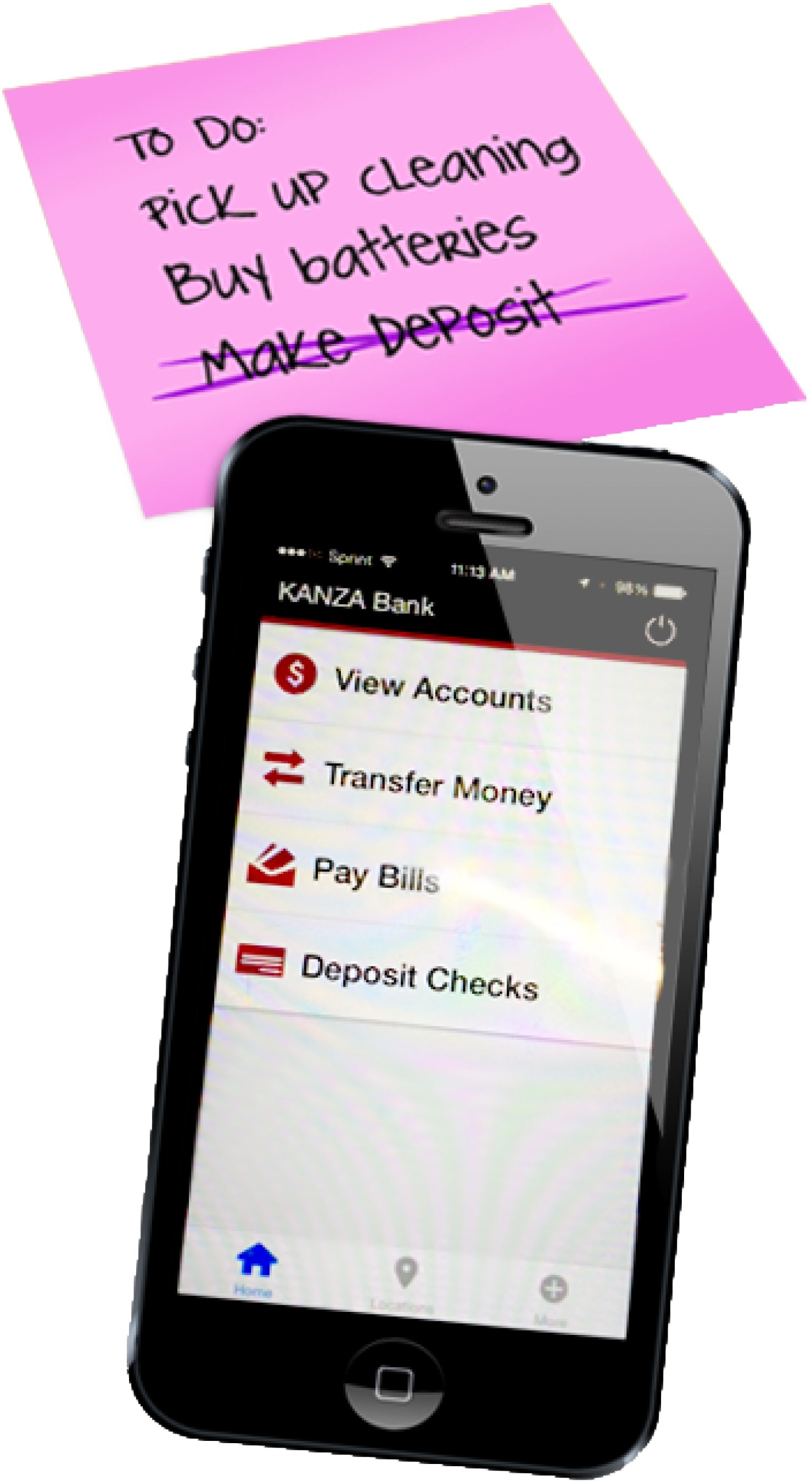

One More Convenience.

One Less Errand.

KANZA Bank Mobile Deposit offers an instantaneous and secure way of depositing checks directly into your account without a trip to the bank.

Follow these easy steps:

Advantages of KANZA Bank Mobile Deposit

- No trip to the bank

- Around-the-clock-deposit-capabilities

- Password-protected, encrypted security

Good To Know

Checks deposited through your mobile device are stored securely at the bank, not on your device. Your check endorsement should be made on the back of the check within 1 ½" from the top edge, and hould say "for mobile deposit." For verification purposes, please retain your check in a safe place until it is verified in your online account. Checks must be from a U.S. institution and in U.S. dollars. KANZA Bank does not charge a fee for using Mobile Deposit but we recommend you check with your service provider regarding wireless carrier fees. A check payable to two payees must be endorsed by both payees. If the check is payable to you OR a joint payee, either of you can endorse it. If the check is made payable to you AND a joint payee, both of you must endorse the check.

To start using KANZA Bank Mobile Deposit, login to your mobile banking account. If you are not enrolled in mobile banking, download our App.

Mobile Deposit Limits

Per deposit limit: $2,500.00

Daily Deposit Limit: $5,000.00

Rolling 30-day deposit limit: $10,000.00